“新冠疫情下通貨膨脹之虛實”

從三個美國統計圖表來看美國通貨膨脹問題的虛實:

1、不計庫存因素,美國經濟的總實質需求,儘管有看似龐大的數兆美元財政支出計畫,迄今還未回到疫情爆發前的趨勢與水準,因此這波物價上漲基本上不是總需求或財政支出所造成。

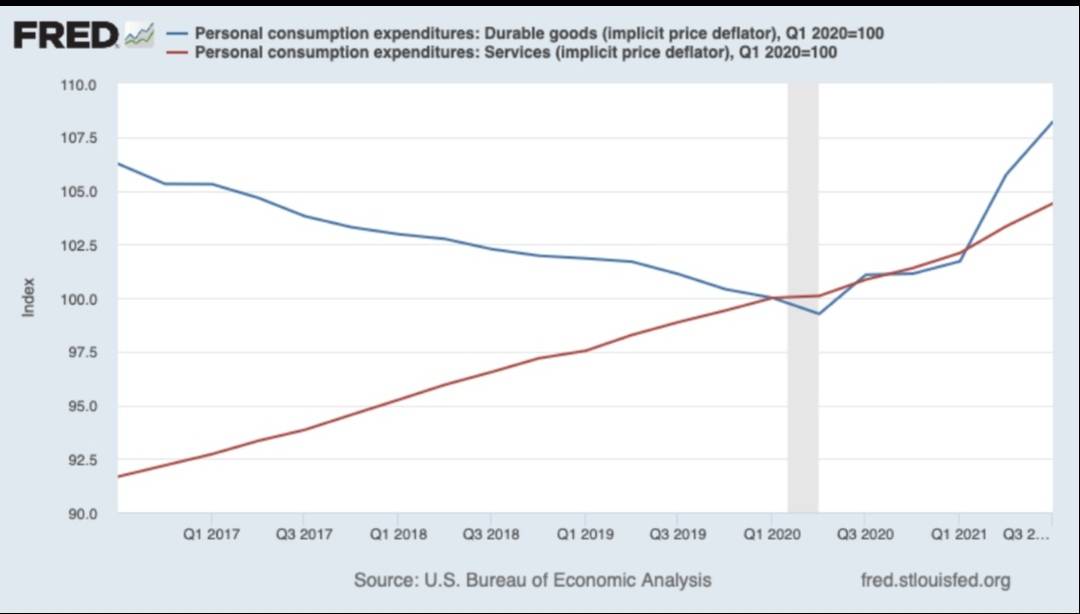

2、疫情爆發瞬間蕭條之後,總需求逐漸、但扭曲地恢復,實體貨品消費陡增,無形服務消費疲弱。實體貨品陡增、過度的需求,導致供應鏈瓶頸、貨運堵塞,物價上漲。瓶頸去除,需求扭曲回復正常後,物價即可能回穩。

從圖表上看,五、六月以後的實體貨品需求陡降,服務商品需求緩升,此狀況持續的話,有可能,目前上漲、瓶頸、堵塞的情境會逆轉。

3、實體貨品之價格,由於科技進步,長期以來一直在下降;服務價格則持續揚升。疫情爆發導致實體貨品價格趨勢逆轉,由下跌轉為快速上漲;服務商品價格則維持既有上漲趨勢。顯示,實體貨品疫情爆發後的陡增需求,係此波通貨膨脹之主要因素。實體貨品價格回復長期持續下降趨勢後,此波通貨膨脹將回穩,如發生鐘擺效應,甚至可能造成一時的通貨緊縮。

-

以下是諾貝爾經濟學獎得主Paul Krugman的專欄看法:

-

First, because inflation reflects the huge surge in demand for durable goods, not the much slower growth in overall demand, a smaller Biden spending plan wouldn’t have made much difference. Even if demand had been a point or two lower, the rush to buy stuff as opposed to services would still have overwhelmed our logistical capacity.

-

Second, because inflation reflects bottlenecks rather than a general problem of too much money chasing too few goods, it should come down as the economy adjusts. Inflation hasn’t been as transitory as we hoped, but there is growing evidence that supply chains are getting unkinked, which should eventually provide some consumer relief.

-

Finally, even if inflation stays elevated for a while, do we really want to slow the whole economy because bottlenecks are causing some prices to rise? One way to describe the argument of inflation hawks is that they’re saying that we should eliminate hundreds of thousands, maybe millions of jobs because the docks at the Port of Los Angeles are congested. Does that make sense?

-

Now, matters would be quite different if we saw signs of a 1970s-type wage-price spiral. But so far we don’t. And for the time being, at least, policymakers should have the courage to ride this inflation out.

本文於 修改第 5 次