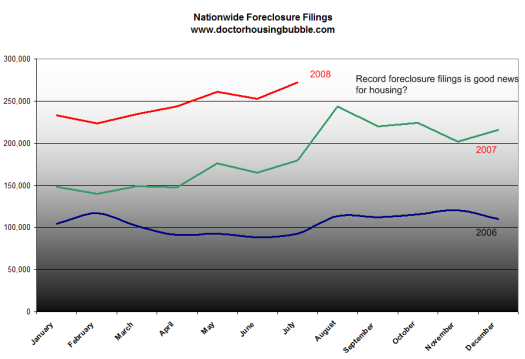

Olympic Gold Medal: Greenspan Tells us Housing will Bottom in 2008. Meantime Foreclosure Filings hit Historical Record. Posted: 14 Aug 2008 02:47 PM CDT ....Today the nationwide foreclosure filings were released and guess what? They are the highest ever! Take a look at this chart:

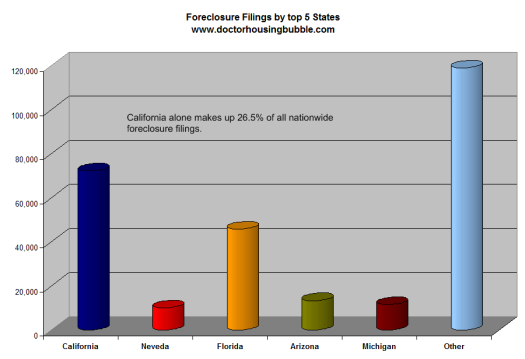

This was the largest number of foreclosure filings ever recorded yet if you look at some of the financial and housing stocks, they rallied because sales increased a bit. Again, ... you'll quickly realize that things are not improving. And you'll also notice how Greenspan talks about national housing prices bottoming in 2009. Which is a nice way of covering yourself since 5 states make up 57% of all foreclosure filings. Places like California won't be hitting a bottom until May of 2011 and the data points to this. Here is a breakdown of foreclosure filings from the top 5 states:

Clearly .... Even with the massive 38% drop, California home prices are still $368,250 while the median household income is $53,770. This ratio is simply unsupportable even at current levels. I've noticed a few mainstream articles cover the so-called shadow inventory issue. We talked about this in the previous articlebut I've raised this issue for months on end. Call it what you want but this is shady manipulation of the market and toying with nuisances of the MLS. Want some proof? Take a look at the July 2008 foreclosure filings for California: July 2008 Data

REO: 23,406 NTS: 12,506 NOD: 36,373 Approximate California Inventory: 310,000 Total Southern California Foreclosure inventory today: 8,548 .... Think about that for a second. Southern California made up 49.4% of all California sales in the month of June. We had 23,406 homes go back to lenders in July and 12,506 trustee sales yet the MLS foreclosure sales are only at 8,548 for Southern California? Let us assume that out of 35,912 homes that were foreclosed in July half are in SoCal. That would push up the inventory numbers by 17,956 just in one month! .... (A)ccording to their data months of inventory is actually getting healthier. It is absurd. REOs are being understated to the point of being criminal. ...like they saw nothing wrong with subprime lending. When you look at various sources, isn't apparent what is going on? Greenspan should win a medal for revising history. Clearly people are now trying to underplay the actual market data and want to believe that housing is at a bottom. Anyone with an ounce of logic can see the numbers above and see something is clearly wrong. |

****** ******* *******

My first response:

My salute to Dr. Housing Bubble.

In a very short article, Dr. Housing Bubble covered so many doubts I have and provided his explanations:

1) FDIC and OTS took over Indymac Bank on July 11, 2008. In fact, it is a "nationalization" of Indymac Bank to wipe out private IMB shareholders, without solid reason, as Greenspan suggested to two GSEs. IMB had never been on the watch list of FDIC 30 risky banks this first quarter. Hardly to say whether it was on the list until the month of July. The only one reason OTS officially admitted for them to take over IMB is that they "believed"there is a situation with that Indymac couldn't deal. In short, OTS did not believe Indymac could handle customers to "run a bank." Is that what's the situation and who created it? Go ask Senator Schumer about his series of "concerns" sent to FDlC and what's happen after his letters?

Now, let me ask you a question: Is there any banker, including JP Morgan, Citi, BofA, who can deal with such a situation Indymac faced that most of his depositors want move money out of his bank? Bear in your mind, how much cash reserve the banker has in order to run a federal banking business. If the legal requirement is only 10% to 15%, how could he or she have the cash liquidity when all he/she has is those auction-grade securities at hand?

Next, if all of our bankers would be unable to meet the challenge created by Schumer's situation of political manipulation, why pick on Indymac Bank alone? Could Washington Mutual or Downey Savings handle it? Or name me one who can?

Thirdly, we America is a free society. Could we be allowed to do things so radical as a communist to "nationalize" a private company to wipe out its shareholder's interest? Is it what we called "due process" or "ends justify means"?

I sure agreed on Dr. Housing Bubble's saying: "Baloney." Common, that' a wrong answer. Give me a better one.

2) I especially love these two expressions of Dr. Housing Bubble: "the logic is rather simple" and "Anyone with an ounce of logic can see the numbers above and see something is clearly wrong. However, I am just wondering how many people have an ounce of logic when manias exist with herd mentality in his brain?

3) I have been wondering where those REOs have gone for a year. How could they disappear in the thin air of writeoff or writedown? Then, who is supposed to hold the bag?

As figures said, in SoCal, we had 23,406 homes go back to lenders in July 2008 and total accumulated inventory of REOs should be 310,000. In the summer of 1996, we saw the highest number in foreclosure activity report of about 60,000 at the peak. Clearly, the situation is a lot worse than that, about 5 times more activities in foreclosure.

But how come we have only 8,548 REO listed on the market? Why those financial institutions are seemed not "anxious" in selling those "non-performing assets (allow me to say more precisely a.k.a. debts" or giving a hard time to give an approval to shortsale agents. A lot of smokes here, are there some other "game plays" for them sitting comfortably on the "junk portfolio" and waiting to be "rescued" at other's expenses?

4) According to real estate statistics, there is only about 5 percent of our existing residential units that is available for purchase. Some economic students said that creating 19 times wealth to our people (95% divided by 5%=19). Yes, we felt so rich when housing prices went up, but it is just a "equity" or credit. Everyone with knowledge knows the difference between warm "credit" and cold "cash." Also, as Prof. Lestor Thurow said, our American economy is hardly qualified as a "perfect competition" model. Indeed, we are an oligarchy market. If everyone put his own house on the market, we would have a "perfect" market and price would be amazingly lowed.

Clearly, it is not the case in our scoiety. But how could the 5% affect the other 95%? How come our lawmakers are seemed very concerned about the 5% and have tried to rescue them by at least putting our green dollar at hugh risk and inviting "inflation"? Who is daring to ask those 5% liable for what they have recklessly done? To avoid them as plaque and have a surgical operation to get rid of them as a cancer to our body. Who would take care of the majority of taxpayers to stop the cancer spread (a.k.a. subprime toxic loan spillover)? Looking around, there is none, except the Indymac's downfall.

Recently when my neighbors came to my doorsteps and asked me to loan them $20 for their gas purchase, I wish someone who runs for the recent presidential campaign could come up and say, "Enough is enough. Let's get down to the Earth and do the basics to take care of our own people first."

Don't tell me that I am a protectionist when we spent trillions of dollars to be nice to other people and ignore the poverty in our backyard in which 20-25% of our American (a.k.a. poor folks) faced and suffered.

Sen. Schumer gave 4 Gold Medals of "Bad Policy Olympic" to Bush administration yesterday for surging foreclosure, highest inflation, job loss. Why didn't the Senator give Himself the 5th one of "politic interworking with economy"?

I am sure be very happy to give Dr. Housing Bubble a Gold Medal for his "Good Insight."

I hope, someone has the guts to tell us the real picture or interesting stories. And I believe it would be as interesting as the $100 billion JP Morgan and other big corporations are NOW so eagerly making a $6 stove sale to people in the 3rd world. Be careful, use your imagination to not look down at JP Morgan! Through the "skilled" handling, a huge profit can be created by their magic wands: $30 of carbon credit out of every smallest deal as valued as a $6 McDonald's hamburger package.

Gee! make a profit of $30-60 out every sale of $6, I have to say "mission impossible" done perfectly. I couldn't done better than that.

雲遊去了﹐有緣自聚

本文於 修改第 1 次